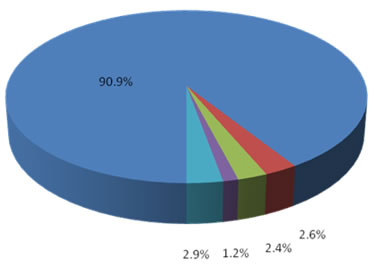

Cost Breakdown

Delivered Gas Cost

This chart is a real representation of the DELIVERED cost of natural gas. The costs DO NOT include the local delivery cost of the utility (LDC). This graphic should clarify the need to monitor and manage the commodity cost of natural gas to maximize savings and minimize risk.

![]() Commodity

Commodity

![]() Shrink/Pipeline Fuel

Shrink/Pipeline Fuel

![]() Interstate Transportation

Interstate Transportation

![]() Administration

Administration

![]() Profit and Commissions

Profit and Commissions

Index Priced Gas

Index Priced Gas is gas bought at market prices. The price is based on an index (like the graph below of the NYMEX index for May 2013 natural gas futures) with a markup or “basis” over and above the index to cover the balance of the costs to get the gas delivered as shown in the pie chart above. This method poses the most risk for buyers since it is subject to market swings based on weather, price speculation, etc. Most LDC’s standard approved rates include a market based price option.

Fixed Priced Gas

Fixed Priced Gas is gas contracted for purchase in advance, based on futures contract pricing as shown here. For instance, based on market prices at the time this “snapshot” was taken, the commodity cost of natural gas delivered in May 2013 would be $4.147/dekatherm.

A specific volume of gas can be contracted for in advance for delivery in a specific month. Because this gas is usually purchased in 10,000 dekatherm “contracts”, most end users become a part of a marketer’s “pool” of customers to make these fixed price plans work. Most of the time, “strips” of months (e.g., November-March) are purchased to hedge risk in volatile market conditions.

Storage Gas

Storage Gas is gas purchased prior to the month in which it is delivered. Most often, storage gas is purchased in the (historically) lower cost summer months (April-Oct) and injected into storage, for withdrawal in the winter. Storage gas is paid for in the injection month, thus reducing winter cash flow requirements as well. Storage is a very useful hedging tool in order to both reduce risk and manage costs.